For a publisher who hedges their bets on just a handful of major game series, Destiny was a big deal for Activision. First announced in 2013, the game had been heavily promoted beginning with an unprecedented pre-E3 2013 (over a year before release) extended TV trailer and culminating with multiple TV spots around launch and a takeover of Times Square. Yes, Destiny was destined (pun intended) to be the next major IP for the major studio, no matter what the game actually was or how it turned out to be. In fact, both of those answers were belated due to a tight review schedule that didn't see a single review for nearly a week. Now that the game has been out for almost month, however, the real test is beginning. Its success can no longer be judged on hype and now must be judged on short and long-term financial results. And currently, they're not looking so great.

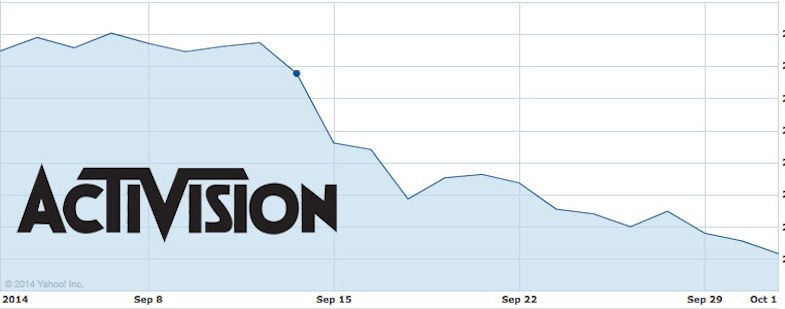

When Destiny was released on September 9, Activision Blizzard's stock was sitting just north of $24.00. Just under a week after launch, the stock saw an almost 2 point drop down to $22.31 -- which was the company's steepest drop in over a a year. This came in the wake of news coming out that the game had sold through $325 million of units in five days. While this was an impressive number for a new IP, it paled in comparison to the recent success of similarly mega-budget, mega-promoted games Grand Theft Auto V and Call of Duty: Black Ops II, the former of which sold a billion dollars in three days.

Since then, the stock has dropped even further and closed today half a point down at $20.13. In the almost thirty days since release, there's only been four days of gains (and minor ones at that) with the rest dominated by losses or even days.

In that time, Activision has released one other major game -- Skylanders Trap Team -- on Sunday. It's too soon to yet see stock fluctuations based on this recent release, so the past month of Activision's performance falls on Destiny. If one looks at the stock over the past four months, it was steadily climbing. This came on the heels of E3 2014, where the game dominated conversation and collected numerous rewards. It seems that investors were betting on Destiny being the next big thing in the industry, and now that it's turning out to simply be a high-selling FPS, they're starting to ease off their confidence in Activision a bit.

It likely won't get any better for Activision in the next month, as Destiny sell-through rates have been steadily declining week over week.

That being said, it's hardly doom and gloom for the publisher. They remain up over 20% year to year and are still currently higher than any year pre-2014. Their market cap is 14.4 B which makes them a Large Cap company. Their EPS (Earings Per Share) is sitting at $0.84 which means that $20.13 gets you $0.84 in Activision money. This isn't amazing, but it's respectable for a video game publisher listed on NASDAQ. Their P/E ratio is 23.88 which again is admirable. Finally, the company remains paying a dividend which indicates they're clearing a good profit.

Activision is still sitting pretty and if things even out, they'll remain one of the most successful video game publishers. Destiny is far from signaling doom for Activision, but it's not a good sign for the franchise itself.

The big test for the publisher will be Call of Duty: Advanced Warfare in early November. Still their undisputed cash cow, this is arguably the most important year for the franchise yet with the first release on a current-gen platform built from the ground up as well as competition from other emerging series like Titanfall.